Search for Toll Violation Invoices. Payment Plans EZ TAG Express. Smith, This is just a friendly reminder that your account is.

the name of the company the debt collector is collecting money forTell the debt collector that you'll call back as soon as you verify the information. the company the debt collector works for What to do when a debt collector callsMake sure to ask for and write down the following information: landlords may refuse to rent to you or charge you more for rentSee how long information stays on your credit report. insurance companies may charge you more for insurance lenders may refuse you credit or charge you a higher interest rate

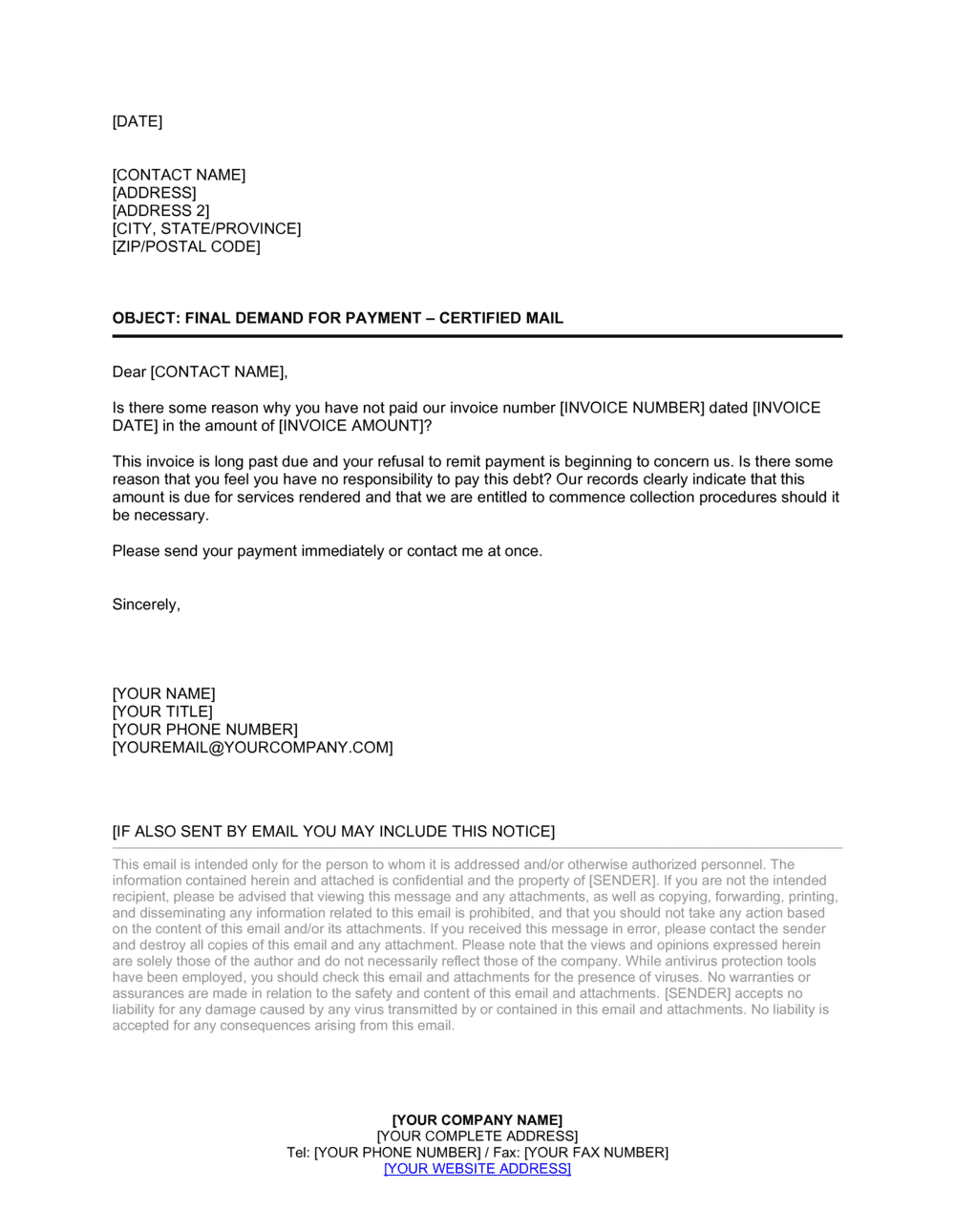

Collection Letter Payment Plan Full Amount You

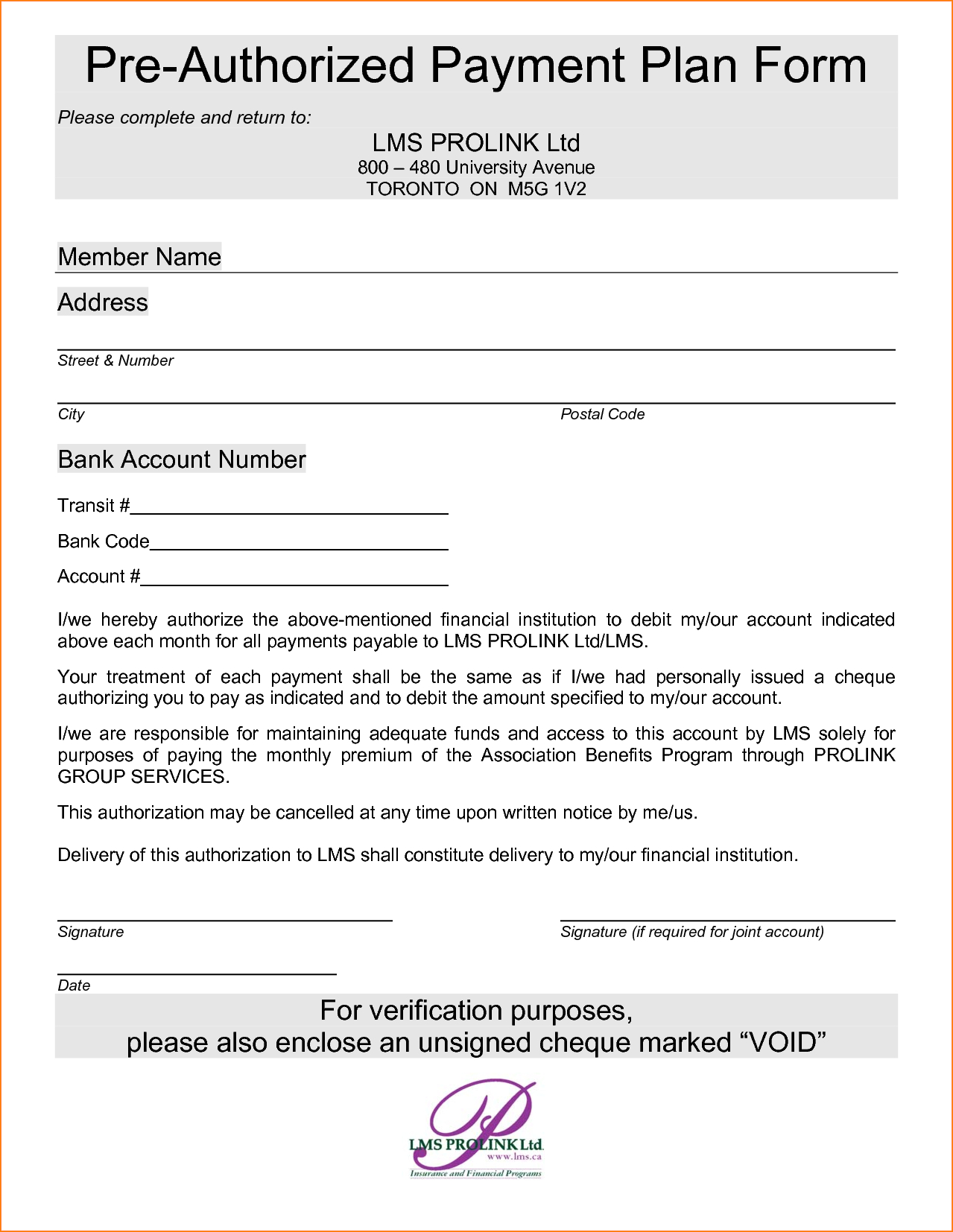

always get a receipt for any payment you make Paying your debt once it has been transferred to a collection agencyIf the debt is yours and the amount is correct, paying the full amount you owe will resolve the issue. Ask your legal advisor to send a written request to your creditor by registered mail, including an address and phone number at which you may be contacted.

Your rights when dealing with a debt collectorYou have rights with respect to how the debt is collected when dealing with a debt collector from a federally regulated financial institution or another party acting on its behalf. check your credit report to see if the debt appears on your reportCheck for errors on your credit report. contact the creditor to find out what steps you need to take to correct the error include a first payment to show your commitment to paying back the debt, if possibleWhat you should do if the debt isn't yoursIf you think that the debt isn’t yours, or that an error has been made: offer an alternate method of repayment, such as monthly payments don’t contact the creditor that lent you money, as this might create confusionIf it’s not possible for you to pay the full amount:

Sundays between 1:00 p.m. Monday through Saturday between 7:00 a.m. When a debt collector can contact youA debt collector can only contact you at the following times: you've given your consent to the financial institution that they can contact the personIf you gave consent orally to your financial institution, you must receive written confirmation of your consent either on paper or electronically. your employer is contacted to confirm your employment the person being contacted has guaranteed (or co-signed) your loan

use threatening, intimidating or abusive language suggest to your friends, employer, relatives or neighbours that they should pay your debts, unless one of these individuals has co-signed your loan What a debt collector can't do

a debt collection agency hired by a federally regulated financial institutionContact the Financial Consumer Agency of Canada.If your creditor sold your debt to a collection agency and you want to make a complaint about the agency’s debt collection practices.Contact the consumer affairs office of your province or territory. the debt collection department of a federally regulated financial institution fees for non-sufficient funds on payments that you submittedMaking a complaint about a collection agencyIf you feel that the debt collector you're dealing with isn't respecting your rights, contact the appropriate regulator. call you on your cell phone, unless you've provided that number as a way to reach youA debt collection agency can't add any collection-related costs to the amount you owe other than: misrepresent the situation or give false or misleading information

0 kommentar(er)

0 kommentar(er)